Analysis of Trades and Trading Tips for the Euro

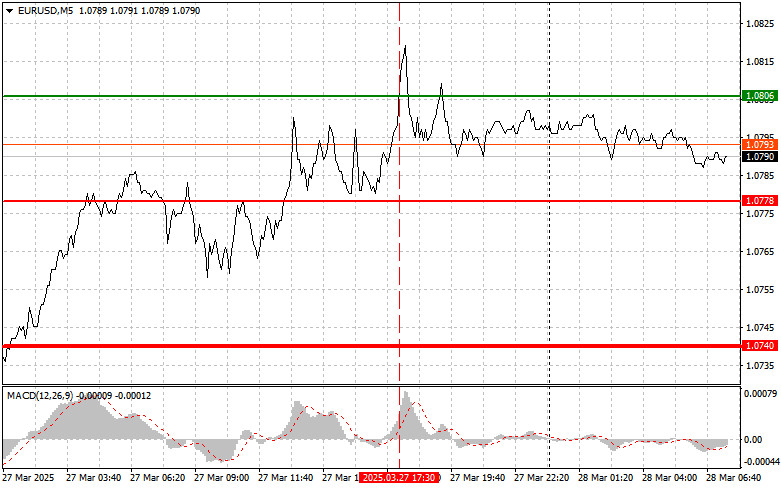

The price test at 1.0806 occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upside potential. For that reason, I didn't buy the euro. By the end of the day, I didn't see any other market entry points.

The dollar gained against the euro as traders interpreted U.S. data positively, seeing it as an indication of the ongoing strength of the American economy. The upward revision of GDP indicates that the U.S. economy was stronger at the end of last year than previously expected. This may ease recession concerns and support a more hawkish stance from the Federal Reserve regarding future interest rate decisions.

Today may bring a new wave of volatility, driven by the upcoming release of key economic data from Germany. Preliminary consumer sentiment data is expected, reflecting German consumers' confidence and willingness to spend. Weak readings could signal ongoing economic challenges. The release of data on the change in the number of unemployed and the overall unemployment rate in Germany could support the euro, as the German labor market remains relatively strong. A decline in jobseekers and a decrease in the unemployment rate could significantly boost EUR/USD's upside potential toward the end of the week.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Signal

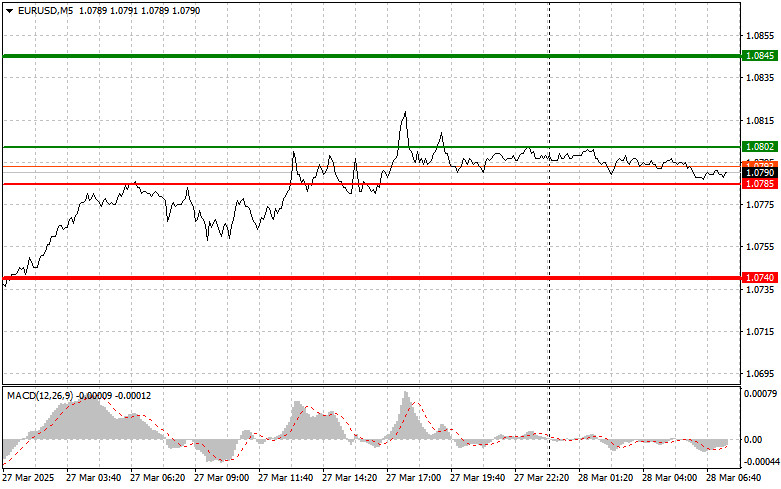

Scenario #1: I plan to buy the euro today if the price reaches around 1.0802 (green line on the chart), intending to rise to 1.0845. At 1.0845, I intend to exit long positions and open short positions in anticipation of a 30–35-pip pullback from the entry point. A rise in the euro in the first half of the day is more likely if strong German data is released. Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the euro today if the pair tests the 1.0785 level twice consecutively while the MACD indicator is in the oversold area. This would limit the pair's downside potential and trigger a market reversal to the upside. A rise toward the opposite levels of 1.0802 and 1.0845 could be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.0785 (red line on the chart). The target will be the 1.0740 level, where I intend to exit short positions and immediately open long positions in the opposite direction (expecting a 20–25-pip rebound from the level). Pressure on the pair will likely return if economic indicators disappoint. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to move downward.

Scenario #2: I also plan to sell the euro today in the event of two consecutive tests of the 1.0802 level while the MACD indicator is in the overbought area. This would limit the pair's upside potential and trigger a downward reversal. A decline toward the opposite levels of 1.0785 and 1.0740 could be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.