Analysis of Wednesday's Trades

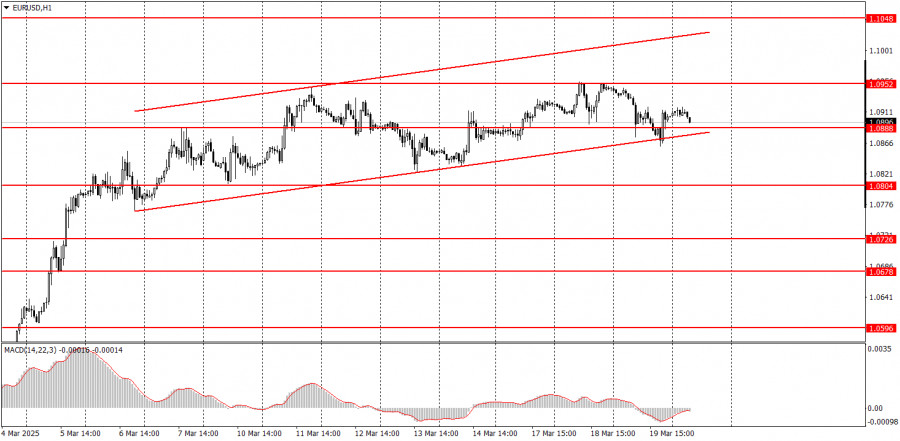

1H Chart of EUR/USD

The EUR/USD currency pair traded with a slight decline on Wednesday, which was purely coincidental, as the pound sterling also closed lower than Tuesday's. The upward movement remains stable, as indicated by forming a new ascending channel. The price is currently near the lower boundary of this channel, and if it breaks below, it could trigger a long-awaited drop. Regardless of the factors weighing on the U.S. dollar, it has already fallen too much. Donald Trump's tariffs have barely taken effect, and the U.S. economy remains strong, as even Jerome Powell acknowledged yesterday. Therefore, there is no reason for a massive sell-off of the dollar. The dollar's decline is tied to Trump's trade policies but cannot and should not fall forever. Thus, we expect the price to break below the ascending channel, leading to U.S. dollar strength.

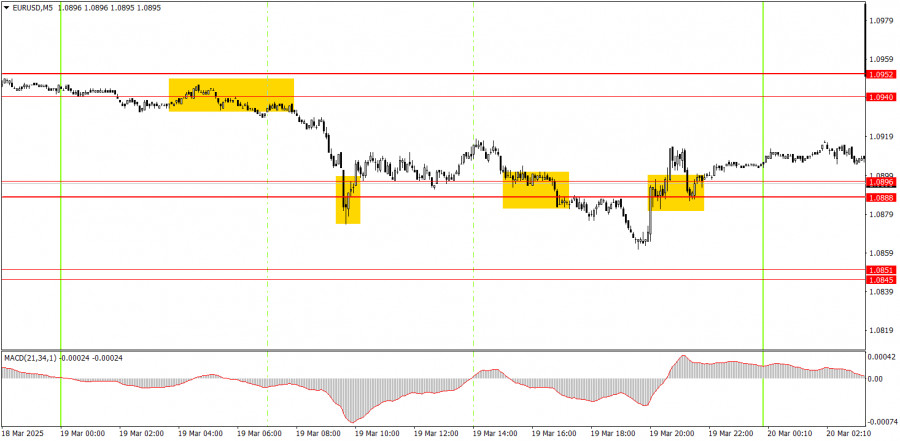

5M Chart of EUR/USD

On the 5-minute timeframe, three trading signals formed on Wednesday, but the main price movement occurred in the evening when the Federal Reserve meeting concluded. At that time, opening positions was quite risky. Thus, only two signals were available for novice traders—both formed during the European trading session. The first was a bounce from the 1.0940-1.0952 zone, and the second, though less precise, was a bounce from the 1.0888-1.0896 area. The first signal yielded a decent profit, while the second trade closed at breakeven.

Trading Strategy for Thursday:

On the hourly timeframe, EUR/USD is still in a medium-term downward trend, though the chances of its continuation are diminishing. Given that fundamental and macroeconomic factors still support the dollar far more than the euro, we continue to expect a decline. However, Trump's trade policies push the dollar lower, overshadowing macroeconomic fundamentals. Politics and geopolitics dominate market sentiment, so we continue to see persistent dollar weakness.

On Thursday, the euro may trade in either direction, as macroeconomic and fundamental data currently have little influence on price movements. Given this, traders should focus on trading from the lower boundary of the ascending channel on the hourly timeframe.

Key levels on the 5-minute timeframe to consider are 1.0433-1.0451, 1.0526, 1.0596, 1.0678, 1.0726-1.0733, 1.0797-1.0804, 1.0845-1.0851, 1.0888-1.0896, 1.0940-1.0952, 1.1011, and 1.1048. Thursday's key events include Christine Lagarde's speech in the Eurozone and several minor macroeconomic reports in the U.S. We believe the euro is overbought, and a correction is due. A break below the ascending channel could serve as a signal for this correction.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.