Analysis of Trades and Trading Tips for the Euro

The test of the 1.0459 price level occurred when the MACD indicator had already moved significantly downward from the zero mark, which limited the pair's downside potential. For this reason, I did not sell the euro, and I also did not receive any other entry signals.

Yesterday's negative sentiment, driven by Germany's weak IFO index and the lack of news from the U.S., erased the positive momentum that had started the week, which was fueled by the opposition's success in the German elections. As a result, the euro declined, retracing back to early-week levels. This situation highlights the fragility of market optimism and its sensitivity to macroeconomic realities. Investors seem to have shifted their focus from political factors to economic fundamentals, particularly data from the Eurozone. Today, the spotlight is on Germany's GDP report.

A contraction in Germany's GDP for the fourth quarter is expected. Economic slowdown in Europe's largest economy could raise concerns not only domestically but also on the global stage. Current data suggest worsening economic conditions, which will undoubtedly affect investment decisions. In light of this, pressure on the EUR/USD pair is increasing, and investors must remain cautious. Weak GDP figures could push the European Central Bank toward an even more dovish monetary policy, increasing market volatility.

For intraday trading, I will focus primarily on executing Scenario #1 and Scenario #2.

Buy Signal

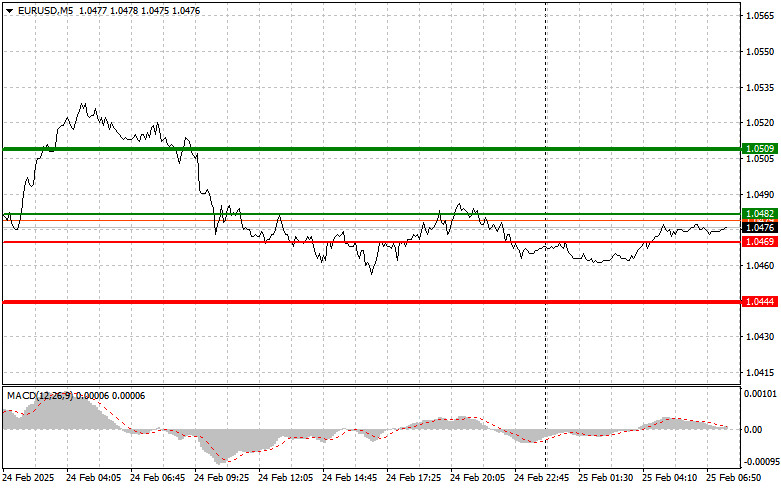

Scenario #1: Buying the euro today is possible if the price reaches 1.0482 (green line on the chart) with a target of 1.0509. At 1.0509, I plan to exit the market and sell the euro, aiming for a 30-35 pip movement in the opposite direction. Expecting euro growth in the first half of the day is reasonable only if economic data from the Eurozone and Germany is very strong. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the euro today if the price tests 1.0469 twice in a row while the MACD indicator is in the oversold area. This will limit the pair's downside potential and trigger a market reversal to the upside. The potential target levels for growth are 1.0482 and 1.0509.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.0469 level (red line on the chart). The target will be 1.0444, where I intend to exit the market and immediately buy in the opposite direction, aiming for a 20-25 pip movement upward. Selling pressure on the pair will return if economic data is very weak. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the euro today if the price tests 1.0482 twice in a row while the MACD indicator is in the overbought area. This will limit the pair's upside potential and trigger a market reversal downward. The expected decline targets 1.0469 and 1.0444.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.