Analysis of Trades and Trading Tips for the British Pound

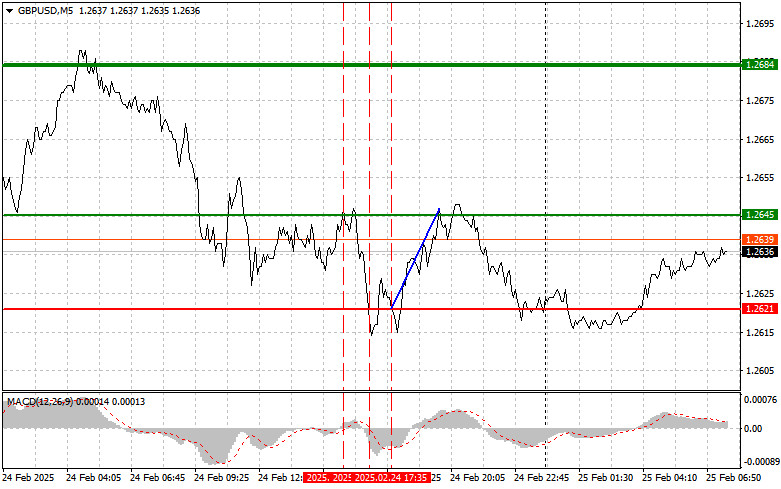

The test of the 1.2645 price level occurred when the MACD indicator was just beginning to rise from the zero mark, which confirmed a valid buying opportunity for the pound. However, as shown on the chart, the pair did not experience significant upward movement, leading to a loss.

By the mid-American session, the first test of the 1.2621 price level occurred when the MACD had already moved significantly downward from the zero mark, so I refrained from selling. The second test of 1.2621 coincided with the MACD being in the oversold area, which allowed me to execute Scenario #2, resulting in a 25-pip increase in the pair.

Technically, buyers still have the advantage, but momentum has clearly weakened. The key factor now will be whether the price can stay above the 1.2600 mark before making new attempts to break through the resistance at 1.2680. In the short term, I expect continued consolidation within the range defined by these levels. Investors are likely to pause ahead of the release of important data from the UK, which has been notably scarce lately.

Though not of primary importance, today's speech by Huw Pill could significantly increase volatility if his rhetoric diverges from market expectations. Investors will pay close attention to his comments regarding inflation, the prospects of further rate hikes, and the general state of the British economy. If Pill expresses concerns about sustained inflationary pressure and hints at the need for a more aggressive monetary policy, the pound could receive short-term support. On the other hand, a more moderate stance could put pressure on the British currency.

Today promises to be relatively calm, but small movements are still likely. Traders are advised to stay alert and monitor news closely.

For intraday trading, I will focus primarily on executing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: I plan to buy the pound today if the price reaches the 1.2645 entry point (green line on the chart), targeting 1.2676 (thicker green line on the chart). At 1.2676, I intend to exit the buy position and open a sell position in the opposite direction, aiming for a 30-35 pip movement back from this level. Buying the pound is possible only after strong statements. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the pound today if the price tests 1.2627 twice consecutively, with the MACD indicator in the oversold zone. This will limit the pair's downside potential and trigger an upward market reversal. The expected growth targets are 1.2645 and 1.2676.

Sell Signal

Scenario #1: I plan to sell the pound today after the 1.2627 level is updated (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be 1.2601, where I plan to exit the sell position and immediately open a buy position in the opposite direction, aiming for a 20-25 pip movement back from the level. Selling the pound is best done as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting to decline.

Scenario #2: I also plan to sell the pound today if the price tests 1.2645 twice consecutively, with the MACD indicator in the overbought area. This will limit the pair's upside potential and trigger a market reversal downward. The expected decline targets are 1.2627 and 1.2601.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.