Argentina

In August, Argentina's inflation rate surged to a staggering 271.5%, the highest in the world. Such an inflation spike can be attributed to several factors, including prolonged economic instability, uncontrolled budget deficits, and a weak national currency, the peso. The Argentine government frequently resorts to money printing to cover its expenses, adding to inflationary pressures. High inflation has already severely diminished purchasing power, lowered living standards, and destabilized the country's financial sector.

Sudan

Sudan's inflation rate reached an impressive 146.6% in August, driven by ongoing political instability and an enduring economic crisis. Since the overthrow of Omar al-Bashir, the country has been plagued by internal armed conflicts that undermine economic stability. The situation is further exacerbated by numerous Western sanctions and restricted access to foreign currency, while the local currency, the Sudanese pound, suffers heavy losses, driving up the cost of essential goods and services.

Turkey

Despite extensive efforts to stabilize its economy, Turkey continues to struggle with high inflation, which stood at 61.78% in August. Key factors include a weakening Turkish lira and rising costs for imported goods, particularly energy resources. Although Turkey’s central bank is taking steps to bring inflation under control, political pressures and complex geopolitical conditions add to the challenges. High inflation affects the cost of living, reduces purchasing power, and leads to a rise in social unrest.

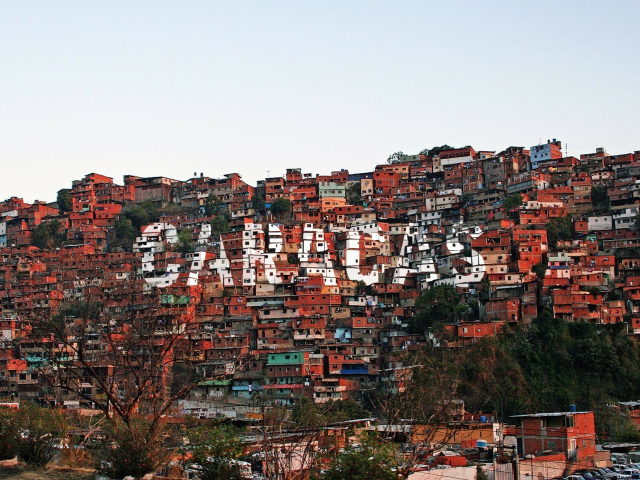

Venezuela

Venezuela, which has long been among the countries with the highest inflation rates globally, is gradually moving away from this status. Over the past 12 months, consumer price inflation has slowed from an eye-popping 138.4% to 51.4%. Despite this significant decline, Venezuela still faces serious problems, including a massive devaluation of the national currency, the bolivar, widespread dollarization of the economy, insufficient imports, shortages of essential goods, low government trust, and severe emigration.

Zimbabwe

Zimbabwe's inflation rate stood at 33.6% in August, marking a substantial drop from the crisis years. Nevertheless, the rate remains high by global standards. The country’s economic troubles stem from chronic budget deficits, corruption, and a weak institutional framework. The national currency continues to depreciate, affecting living standards and the availability of goods and services.

-

Grand Choice

Contest by

InstaForexInstaForex always strives to help you

fulfill your biggest dreams.JOIN CONTEST -

Chancy DepositDeposit your account with $3,000 and get $5000 more!

In November we raffle $5000 within the Chancy Deposit campaign!

Get a chance to win by depositing $3,000 to a trading account. Having fulfilled this condition, you become a campaign participant.JOIN CONTEST -

Trade Wise, Win DeviceTop up your account with at least $500, sign up for the contest, and get a chance to win mobile devices.JOIN CONTEST

518

518 5

5