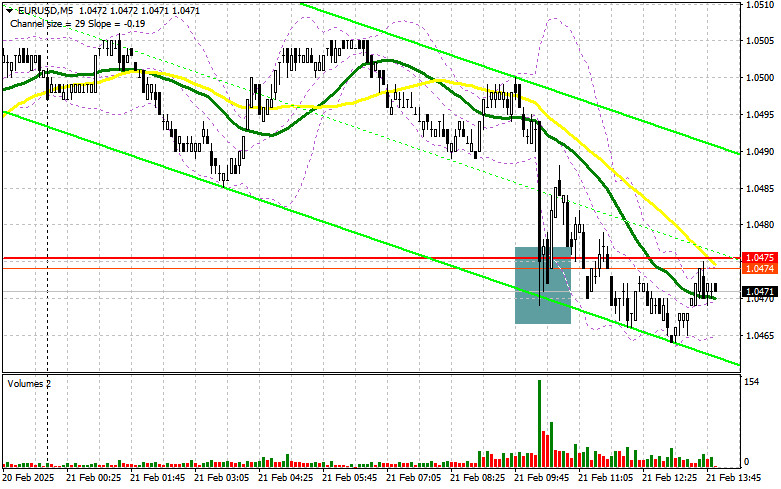

In my morning forecast, I focused on the 1.0475 level as a key entry point. Looking at the 5-minute chart, we can see that a false breakout at this level created a long entry signal, but the pair failed to gain significant upward momentum. Consequently, the technical outlook has been revised for the second half of the day.

Opening Long Positions on EUR/USD

The PMI activity data earlier today disappointed traders, triggering a decline in the euro. Now, attention shifts to the U.S. session, where similar indicators will be released, including the Manufacturing PMI, Services PMI, and the Composite PMI for February. If these figures are not sufficient to dictate market direction, additional focus will be placed on existing home sales and the University of Michigan Consumer Sentiment Index. The final event of the week will be a speech by FOMC member Philip N. Jefferson.

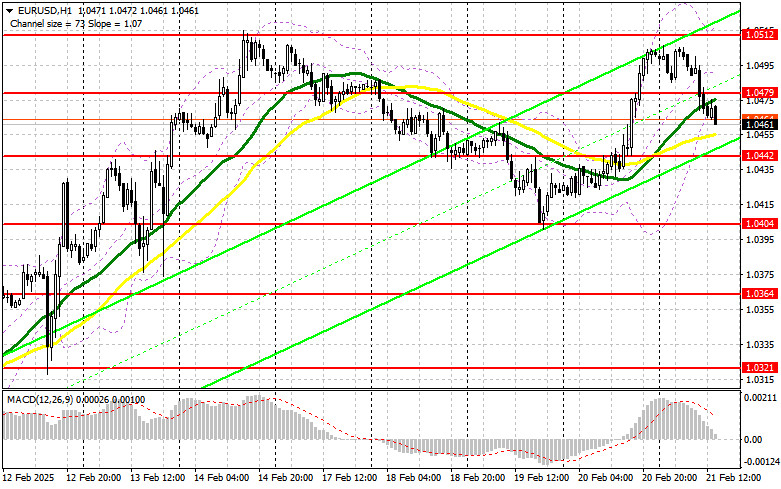

If U.S. data outperforms expectations, it will further pressure the euro, which has been under selling pressure since the Asian session. In the event of further declines, I will consider buying after a false breakout at 1.0442, which could serve as a strong entry point for a rebound toward 1.0479—a level formed during the European session. A break and retest of this range from above would confirm the signal, opening the path to 1.0512, with the final target set at 1.0554, where I will take profits.

However, if EUR/USD fails to hold above 1.0442 and selling pressure persists, buyers will lose control, allowing the pair to drop further toward 1.0404. A false breakout at this level would then provide a buying opportunity. Alternatively, I will enter long positions on an immediate rebound from 1.0364, aiming for a 30-35 point intraday correction.

Opening Short Positions on EUR/USD

Bearish pressure on the euro remains strong due to weak economic data from the Eurozone, and further solid U.S. reports could drive the pair toward yesterday's lows. If EUR/USD attempts a recovery, the focus will shift to defending the 1.0479 resistance. A failed breakout at this level will confirm that sellers remain in control, setting up a decline toward 1.0442, where the moving averages currently favor bulls.

A break and retest of 1.0442 from below would reinforce the downside move, targeting 1.0404, which could halt the euro's short-term bullish momentum. The final target is 1.0364, where I will take profits.

If the euro rallies in the second half of the day and sellers fail to defend 1.0479, bulls could push the pair higher. In this scenario, I will wait for a failed breakout at 1.0512 to initiate short positions. Otherwise, I will sell at 1.0554 on a direct rebound, expecting a 30-35 point correction.

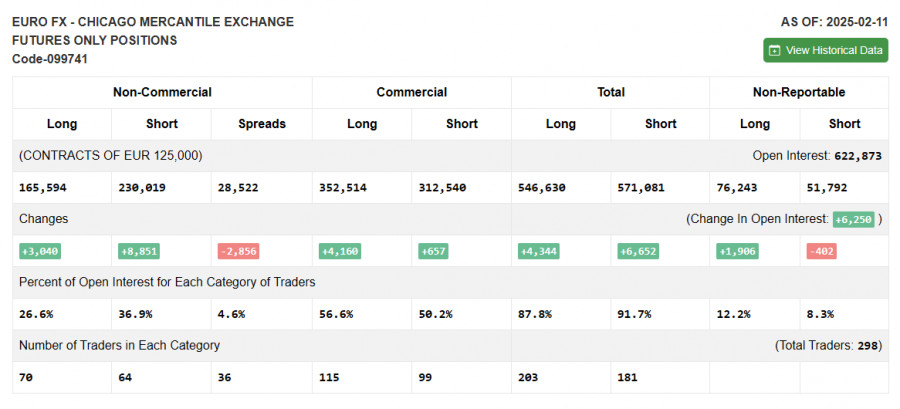

The Commitments of Traders (COT) report from February 11 showed an increase in both long and short positions, but overall, there were more sellers than buyers. However, this data does not account for the recent conversation between Putin and Trump, which may have shifted market sentiment in favor of euro buyers—a development we will only see reflected in next week's report.

For now, U.S. dollar weakness persists, largely due to lackluster U.S. economic data. According to the latest COT report, long non-commercial positions rose by 3,040 to 165,594, while short non-commercial positions increased by 8,851 to 230,019. This resulted in a net decline of 2,856 in the gap between long and short positions.

Indicator Signals

Moving AveragesEUR/USD is trading near the 30 and 50-day moving averages, indicating market uncertainty.

Bollinger Bands:If the pair declines further, support is expected near the lower Bollinger Band at 1.0469.

Indicator Overview

- Moving Averages: Define the current trend by smoothing volatility and noise. Period – 50 (yellow line), Period – 30 (green line).

- MACD (Moving Average Convergence/Divergence): Fast EMA – 12, Slow EMA – 26, Signal SMA – 9.

- Bollinger Bands: Measures market volatility. Period – 20.

- Non-Commercial Traders: Speculative traders such as retail investors, hedge funds, and large institutions using the futures market for speculation.

- Long Non-Commercial Positions: The total long open positions held by non-commercial traders.

- Short Non-Commercial Positions: The total short open positions held by non-commercial traders.

- Net Non-Commercial Position: The difference between long and short positions of non-commercial traders.