Analysis of Trades and Trading Tips for the Euro

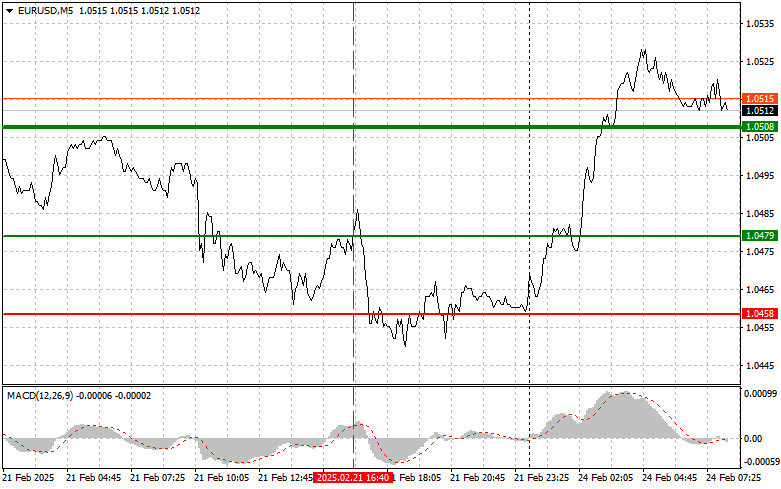

The test of the 1.0479 price level took place when the MACD indicator had already moved significantly above the zero mark, which restricted the pair's potential for further upside. For this reason, I chose not to buy the euro, and I did not identify any other entry points into the market.

During today's Asian trading session, the euro rose sharply. The demand for risk assets was driven by news that Germany's opposition leader, Friedrich Merz, won the federal elections, aligning with public opinion poll results. Markets perceived this news as a sign of stability and predictability in Germany's economic policy and a potential precursor to fiscal stimulus that could boost the eurozone economy. Experts note that Merz's victory reduces the uncertainty that has weighed on the euro in recent months. Additionally, traders paid attention to Merz's rhetoric during his campaign, in which he emphasized the need to strengthen Europe's economic sovereignty and showed a willingness to increase government investments in infrastructure and green energy. According to some experts, this could create favorable conditions for companies focused on clean technologies and the construction sector.

Today, several important economic indicators will be released. The day begins with the IFO data, which includes information on business climate, current conditions, and economic expectations in Germany. It will conclude with the eurozone Consumer Price Index for January and the Bundesbank's monthly report.

Close monitoring of these indicators will play a crucial role in assessing the resilience of the German economy and the overall inflationary situation in the eurozone. Stronger-than-expected IFO results could boost optimism about Germany's economic recovery, supporting the euro. Conversely, weak figures could increase concerns about an economic downturn and pressure the European currency. As for the CPI, market participants will closely watch for signs of persistent inflation. A CPI reading above forecasts may prompt the European Central Bank to take a more cautious approach to rate cuts in the future. On the other hand, a lower-than-expected CPI could reduce the need for ECB action and negatively impact the euro.

For intraday strategy, I will focus more on implementing Scenarios #1 and #2.

Buy Signal

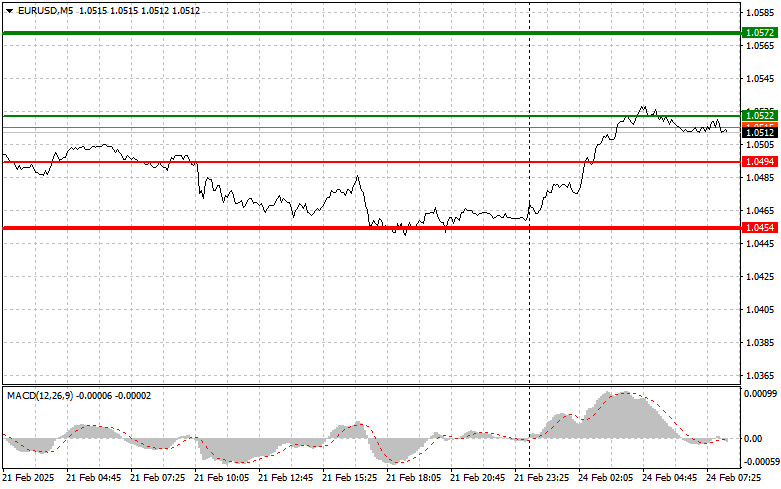

Scenario #1: Buying the euro is possible when the price reaches the 1.0522 level (green line on the chart), targeting a rise to 1.0572. At 1.0572, I plan to exit the market and sell the euro in the opposite direction, aiming for a movement of 30-35 pips from the entry point. Euro growth in the first half of the day can only be expected if eurozone and German data are very strong. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.0494 price level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to a market reversal to the upside. Growth toward the 1.0522 and 1.0572 levels can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.0494 level (red line on the chart). The target will be 1.0454, where I plan to exit the market and immediately buy in the opposite direction, aiming for a 20-25 pip move in the opposite direction. Selling pressure on the pair will return if economic data is very weak today. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.0522 price level while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a market reversal to the downside. A decline toward the 1.0494 and 1.0454 levels can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.