Analysis of Trades and Trading Tips for the Japanese Yen

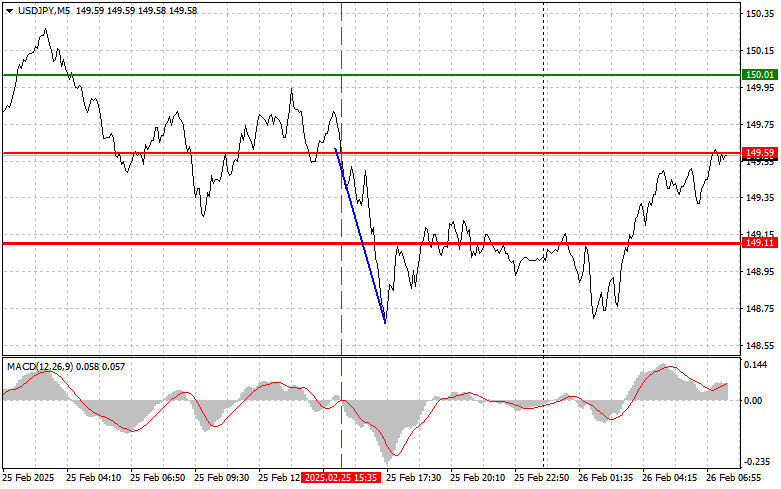

The test of the 149.59 level occurred when the MACD indicator had just started moving downward from the zero mark, confirming the correct entry point for selling the U.S. dollar. As a result, the pair dropped by more than 80 pips.

The yen has reached its highest level in four months, driven by increased risk aversion and expectations of further interest rate hikes from the Bank of Japan, which has made it more attractive to traders. Optimism about the yen's performance is high for the upcoming year, with many betting on additional rate hikes by the BOJ. Overnight index swaps have already fully anticipated a borrowing cost increase by September, with a 50% chance of a rate hike occurring as early as June.

Today's core consumer price index (CPI) growth data from the BOJ provides clear evidence that the central bank will not delay its decision. The acceleration of inflation surpassing the target level creates pressure for a monetary policy revision. Despite concerns about its impact on economic growth, the BOJ recognizes the need to curb inflation. Further delays could undermine confidence in the central bank and lead to more drastic measures in the future.

Regarding intraday strategy, I will primarily rely on Scenario #1 and Scenario #2.

Buy Signal

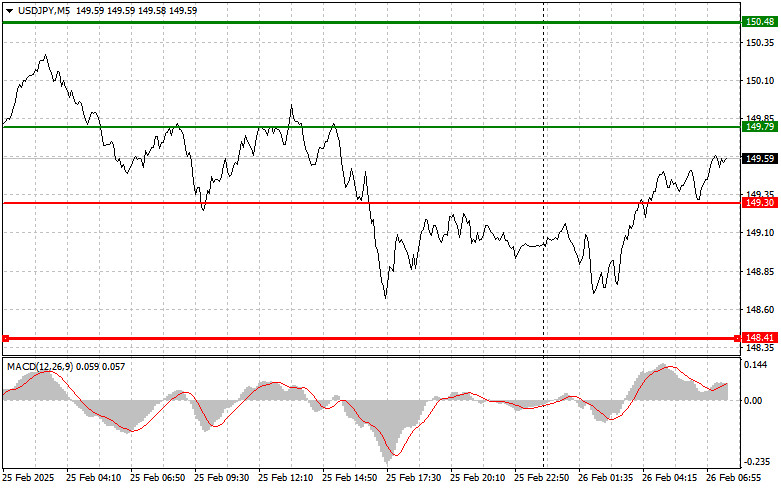

Scenario #1: I plan to buy USD/JPY today if it reaches the 149.79 level (green line on the chart), aiming for an increase to 150.48 (thicker green line on the chart). At 150.48, I will exit my buy positions and open sell positions in the opposite direction, expecting a 30-35 pip decline. It is best to return to buying the pair after corrections and significant pullbacks in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 149.30 level while the MACD indicator is in the oversold zone. This would limit the pair's downside potential and trigger a reversal to the upside, with potential targets at 149.79 and 150.48.

Sell Signal

Scenario #1: I plan to sell USD/JPY today only after breaking below 149.30 (red line on the chart), likely triggering a sharp decline. The key target for sellers will be 148.41, where I plan to exit my sell positions and immediately open buy positions in the opposite direction, expecting a 20-25 pip rebound. Selling pressure on the pair can return at any moment. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 149.79 level while the MACD indicator is in the overbought zone. This would limit the pair's upside potential and trigger a reversal to the downside, with expected targets at 149.30 and 148.41.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.