The GBP/USD currency pair continues to rise, despite lacking strong justification for its movement this week. In the first three days, no significant reports have been released, and the UK has no major events scheduled for the entire week. Nevertheless, the British pound remains on an upward trajectory.

In recent weeks, we have highlighted two key factors for traders. First, the euro has remained stagnant on the daily timeframe, while the pound has experienced growth. Second, the pound's rise has often not aligned with the macroeconomic and fundamental conditions. While a few moderately positive reports have come out of the UK recently, the likelihood of the Bank of England cutting rates four times this year has decreased due to rising inflation. However, from our perspective, the pound has already priced in these factors.

In the 4-hour timeframe, it becomes evident that the pound's movements against the dollar have been tightening, resembling a compressed spring before it "shoots" in one direction. Next week could be the moment of release. There will be a surge of reports, and the British pound is already overbought on a local level. It has risen more than the fundamentals and macroeconomic conditions justify. Therefore, unless US macroeconomic data disappoints or Donald Trump abandons his tariff plans, we expect a sharp drop in GBP/USD.

The market still views US tariffs as beneficial for the dollar. Trump's recent statements suggest that the economy will grow and thrive. For example, he proposed issuing "gold cards" to those investing $5 million in the US economy. However, as seen in his first term, not all of Trump's plans materialize. No doubt, in a year or two, Trump will claim for the hundredth time that if not for him, America would have fallen into crisis, suffered financial ruin and that Democrats are to blame—while he saved the world. However, market participants are no longer easily swayed by such rhetoric. They have learned to take Trump's statements with a heavy dose of skepticism.

U.S. international partners have also adapted to the situation. Recently, Moscow expressed its disagreement with many of Washington's proposals concerning the Ukraine conflict. While Russia acknowledges progress in negotiations and welcomes continued discussions, it opposes any foreign military presence in Ukraine, the deployment of peacekeepers, and further arms transfers to Kyiv. Additionally, Russia disagrees with several points from an agreement that Trump has repeatedly promoted. According to Trump, the conflict could potentially be resolved as early as this week. However, it raises the question of how this can happen when neither side has participated in negotiations yet.

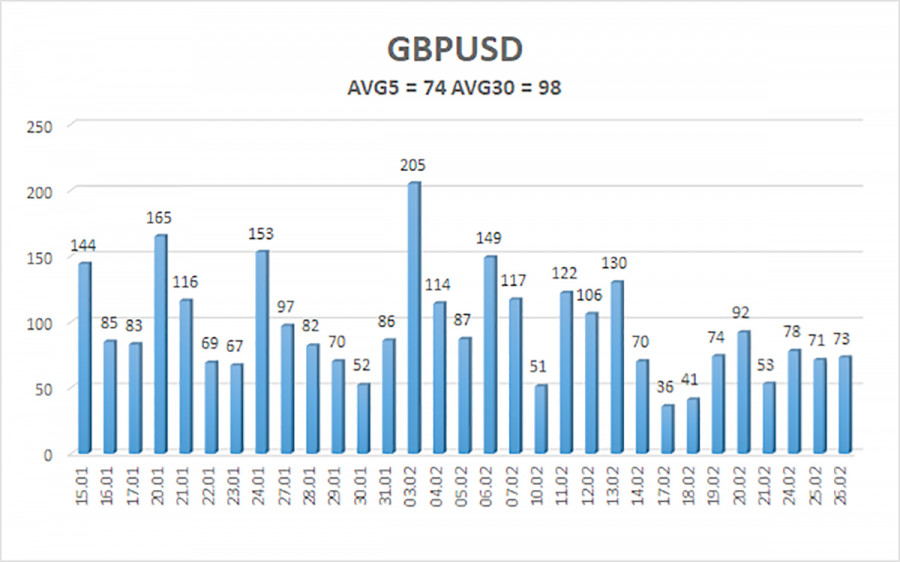

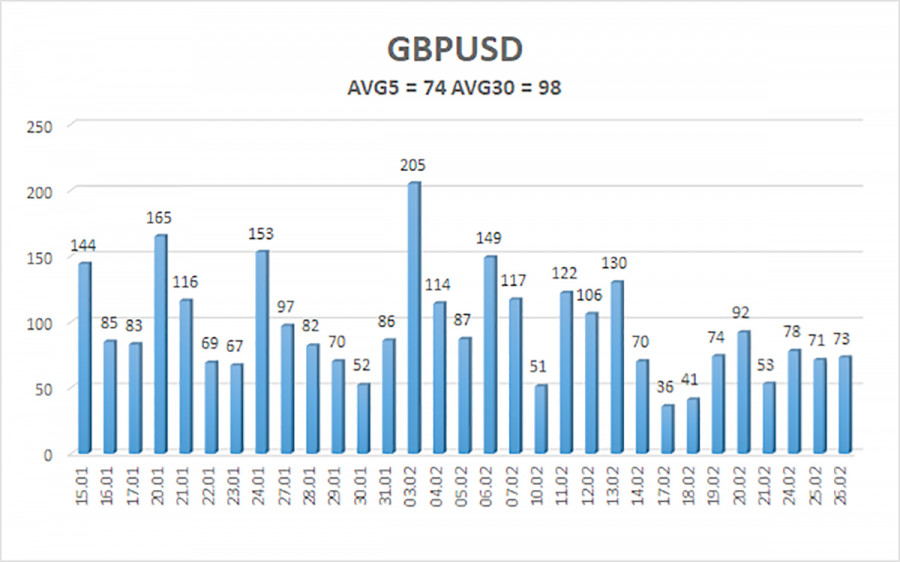

The average volatility of GBP/USD over the past five trading days stands at 74 pips, which is considered "moderate" for this pair. On Thursday, February 27, we expect movement between 1.2621 and 1.2769. The long-term regression channel remains downward, signaling a bearish trend. The CCI indicator entered the overbought zone on Friday, suggesting a new decline is likely approaching. A bearish divergence may be forming.

Nearest Support Levels:

S1 – 1.2634

S2 – 1.2573

S3 – 1.2512

Nearest Resistance Levels:

R1 – 1.2695

R2 – 1.2756

R3 – 1.2817

Trading Recommendations:

The GBP/USD currency pair maintains a medium-term bearish trend. We still do not consider long positions, as the current upward movement appears to be a correction. If you trade purely on technicals, long positions are possible, with targets at 1.2756 and 1.2769 if the price is above the moving average line. However, sell orders remain significantly more relevant, with targets at 1.2207 and 1.2146, as the upward correction on the daily timeframe will eventually conclude. For short positions, at the very least, a firm break below the moving average is required. The pound is already looking locally overbought.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.